Hey there, if you’re like me, you’ve probably stared at your backyard or that extra space on your property and wondered, “What if I could turn this into something that pays me back?” I remember when I first thought about adding a small rental unit to my home a few years ago. My family was growing, bills were piling up, and I needed a way to bring in extra income without uprooting our lives. That’s when I stumbled upon the idea of an Accessory Dwelling Unit – or ADU for short. It changed everything for us, and I bet it could do the same for you.

In this guide, I’ll walk you through what an Accessory Dwelling Unit is, why it’s a game-changer for profitable housing, and how you can get started. We’ll keep it real, share some stories from folks I’ve talked to, and tackle those nagging worries head-on. By the end, you’ll feel ready to take the next step.

Also Read: Mywebinsurance.com Home Insurance: Trusted Coverage & Edge.

What Exactly Is an Accessory Dwelling Unit?

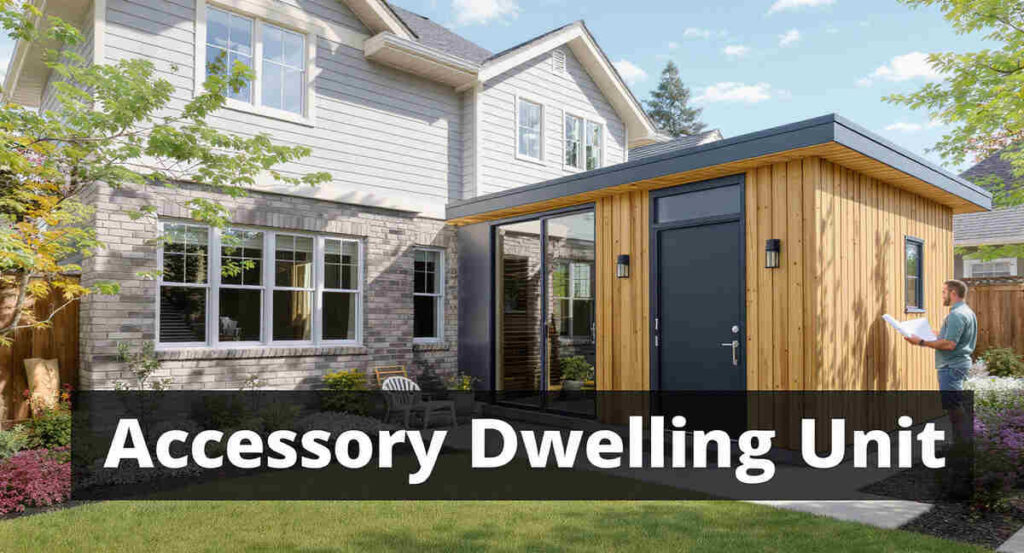

Let’s start with the basics. An Accessory Dwelling Unit is essentially a secondary living space on your property, separate from your main home but still part of the same lot. Think of it as a mini-house – it could be a converted garage, a backyard cottage, or even a basement apartment with its own entrance, kitchen, and bathroom. It’s not just any add-on; it’s designed to be fully functional for independent living.

I recall chatting with my neighbor, Sarah, who built her first Accessory Dwelling Unit after her kids moved out. She turned her unused garage into a cozy one-bedroom spot. “It was like finding hidden treasure in my own backyard,” she told me. And she’s right – these units are popping up everywhere because they’re practical solutions for housing shortages in cities and suburbs alike.

From a technical standpoint, Accessory Dwelling Units come in different flavors. Detached ones stand alone in the yard, attached ones connect to the main house like an extension, and interior ones carve out space inside existing structures. Each type has its pros and cons, depending on your lot size, budget, and local rules. For instance, if space is tight, an attached Accessory Dwelling Unit might save you on construction costs while blending seamlessly with your home.

Why does this matter to you? If you’re dealing with rising living expenses or wanting to house aging parents without sacrificing privacy, an Accessory Dwelling Unit offers flexibility. It’s not about luxury; it’s about smart, everyday problem-solving that can boost your financial security.

Also Read: Mywebinsurance.com Health Insurance: Powerful Savings & Tips.

The Key Benefits of Adding an Accessory Dwelling Unit

Building an Accessory Dwelling Unit isn’t just a project – it’s an investment that pays dividends in multiple ways. Let’s break it down, starting with the money side, because that’s often the biggest motivator.

Financial Perks of an Accessory Dwelling Unit

Imagine generating steady rental income without leaving your property. That’s the reality for many homeowners with an Accessory Dwelling Unit. In my area, rents for these units can range from $1,000 to $2,500 a month, depending on location and size. Over time, that adds up – enough to cover your mortgage, fund vacations, or even build a retirement nest egg.

Take my friend Mike, for example. He added a detached Accessory Dwelling Unit to his suburban lot five years ago. At first, he was nervous about the upfront costs, but within two years, the rental income had paid off the loan he took out. Now, it’s pure profit. “It’s like having a side hustle that runs itself,” he says. And he’s not alone; studies show that Accessory Dwelling Units can increase property values by 20-30%, making your home more attractive when it’s time to sell.

Beyond rentals, these units can qualify for tax breaks or incentives in some regions, especially if they’re used for affordable housing. If you’re in a high-demand area, you might even tap into short-term rental platforms like Airbnb, turning your Accessory Dwelling Unit into a vacation hotspot. Just be mindful of local regulations to avoid surprises.

Also Read: Mywebinsurance.com Life Insurance Secure, Guaranteed Now.

Family and Lifestyle Advantages

Money aside, an Accessory Dwelling Unit can strengthen family bonds and improve your quality of life. Picture this: Your elderly mom moves into the unit next door. She’s independent, but you’re close enough to help with groceries or check in daily. No more long drives to assisted living facilities – it’s a win for everyone.

I’ve heard heartwarming stories from readers who’ve used their Accessory Dwelling Unit this way. One woman shared how it allowed her son to return home after college without cramping the family’s style. “We all have our space, but we’re still together,” she said. It addresses that common pain point of multigenerational living: balancing closeness with privacy.

On a community level, Accessory Dwelling Units help ease housing crises by adding units without sprawling development. If you’re environmentally conscious, many modern designs incorporate green features like solar panels or efficient insulation, reducing your overall carbon footprint. It’s a small step that feels good and aligns with sustainable living goals.

Of course, these benefits don’t come without effort, but the emotional payoff – that sense of security and connection – makes it worthwhile. If you’ve ever felt squeezed by housing costs or family needs, an Accessory Dwelling Unit might be the relief you’re seeking.

Also Read: Mywebinsurance.com Business Insurance: Trusted & Guaranteed.

Planning Your Accessory Dwelling Unit Project

Okay, you’re intrigued – now what? Planning an Accessory Dwelling Unit starts with research and a clear vision. Don’t rush; a solid plan saves headaches later.

Navigating Legal Requirements for Accessory Dwelling Units

First things first: Check your local zoning laws. Not every area allows Accessory Dwelling Units, and rules vary widely. Some cities, like those in California, have loosened restrictions to encourage them, offering pre-approved plans to speed things up. Others might limit size, height, or even require off-street parking.

I learned this the hard way when I helped a relative scout options. We assumed it was straightforward, but permits took months because of setback requirements – how far the unit must be from property lines. Pro tip: Contact your local planning department early. Ask about fees, inspections, and any incentives for energy-efficient builds.

If you’re in a homeowners association, get their buy-in too. They might have aesthetic guidelines to match your neighborhood’s vibe. And don’t forget building codes – your Accessory Dwelling Unit needs to meet safety standards for plumbing, electrical, and fire protection. Hiring a consultant or architect familiar with these can make the process smoother.

Also Read: Mywebinsurance.com Auto Insurance: Affordable Expert Guide.

Design Ideas to Make Your Accessory Dwelling Unit Shine

Design is where the fun begins. Aim for functionality that fits your needs. For rentals, focus on universal appeal: Open layouts, natural light, and durable materials. If it’s for family, customize with features like wheelchair accessibility.

I once visited an Accessory Dwelling Unit that was a converted shed – tiny but clever, with loft storage and a Murphy bed to maximize space. The owner used multifunctional furniture to make it feel bigger. Consider your climate too; in rainy areas, add covered entries, while sunny spots might benefit from patios.

Budget-wise, keep it simple at first. Basic units start around $100,000, but costs climb with custom touches. Sketch your ideas or use online tools to visualize. Remember, the goal is a space that feels welcoming, not crammed. Address common concerns like noise by adding insulation between the main house and unit.

By planning thoughtfully, your Accessory Dwelling Unit becomes more than an add-on – it’s a tailored solution that enhances your property.

Financing Options for Your Accessory Dwelling Unit

Money talks, so let’s discuss how to fund this. Building an Accessory Dwelling Unit isn’t cheap, but smart financing makes it doable.

Home equity loans or lines of credit are popular because they use your property’s value as collateral, often with lower interest rates. If your home has appreciated, you might access tens of thousands without high payments.

Government programs can help too. In some states, grants or low-interest loans support Accessory Dwelling Unit construction for affordable housing. FHA loans now include options for these units, easing the burden for first-timers.

Personal story: When I financed mine, I combined a home equity loan with savings. It felt daunting, but projecting rental income helped. Calculate your ROI – if rents cover the loan in a few years, it’s a no-brainer.

Crowdfunding or partnerships are emerging options. Team up with family for shared costs and benefits. Whatever route, shop around for rates and factor in ongoing expenses like utilities and maintenance.

Also Read: Mywebinsurance.com Pet Insurance Save with Secure Protection.

The Construction Journey for an Accessory Dwelling Unit

Once financed, construction kicks off. This phase can take 3-6 months, depending on complexity.

Hire reliable contractors experienced in Accessory Dwelling Units. Get multiple bids and check references to avoid delays. During build, expect site prep, foundation work, framing, and finishes.

Challenges like weather or supply issues can arise, so build in buffers. I remember a project where unexpected soil tests added weeks, but communication kept stress low.

Post-construction, inspections ensure compliance. Then, furnish simply – think IKEA for affordability. Your Accessory Dwelling Unit is now ready to generate value.

Strategies to Rent Out Your Accessory Dwelling Unit Profitably

To maximize profits, market your Accessory Dwelling Unit effectively. List on sites like Zillow or Craigslist with high-quality photos and details.

Screen tenants carefully for reliability. Set competitive rents based on local comps – too high, and it sits empty; too low, and you undervalue it.

Maintenance is key for long-term success. Regular checks prevent big repairs. If short-term renting, use apps for easy management.

One owner I know nets $20,000 yearly from her unit by targeting professionals. It’s about finding the right fit.

Also Read: Mywebinsurance.com Renters Insurance: Save on Coverage Today.

Overcoming Common Hurdles with Accessory Dwelling Units

No project is perfect. Neighbors might worry about traffic – address by sharing plans early.

Cost overruns? Stick to budgets with contingencies. Permitting delays? Start paperwork soon.

Emotional hurdles, like family adjustments, fade with time. Solutions exist for most issues, turning potential pitfalls into learning opportunities.

In wrapping up, adding an Accessory Dwelling Unit has been one of the best decisions for my family’s stability and finances. It’s not just housing; it’s a path to independence and income. If this sparks something in you, reach out to local experts or share your thoughts below. What’s holding you back from building your own Accessory Dwelling Unit? Let’s chat about it.